MotiSure

Born Out of Grief

Every business has an origin, and for Joel Macharia, it began with personal tragedy. The loss of his cousin—a bodaboda (motorcycle taxi) operator—in a road accident revealed a painful truth: millions of riders across Kenya and Africa face daily risks with little to no financial safety net.

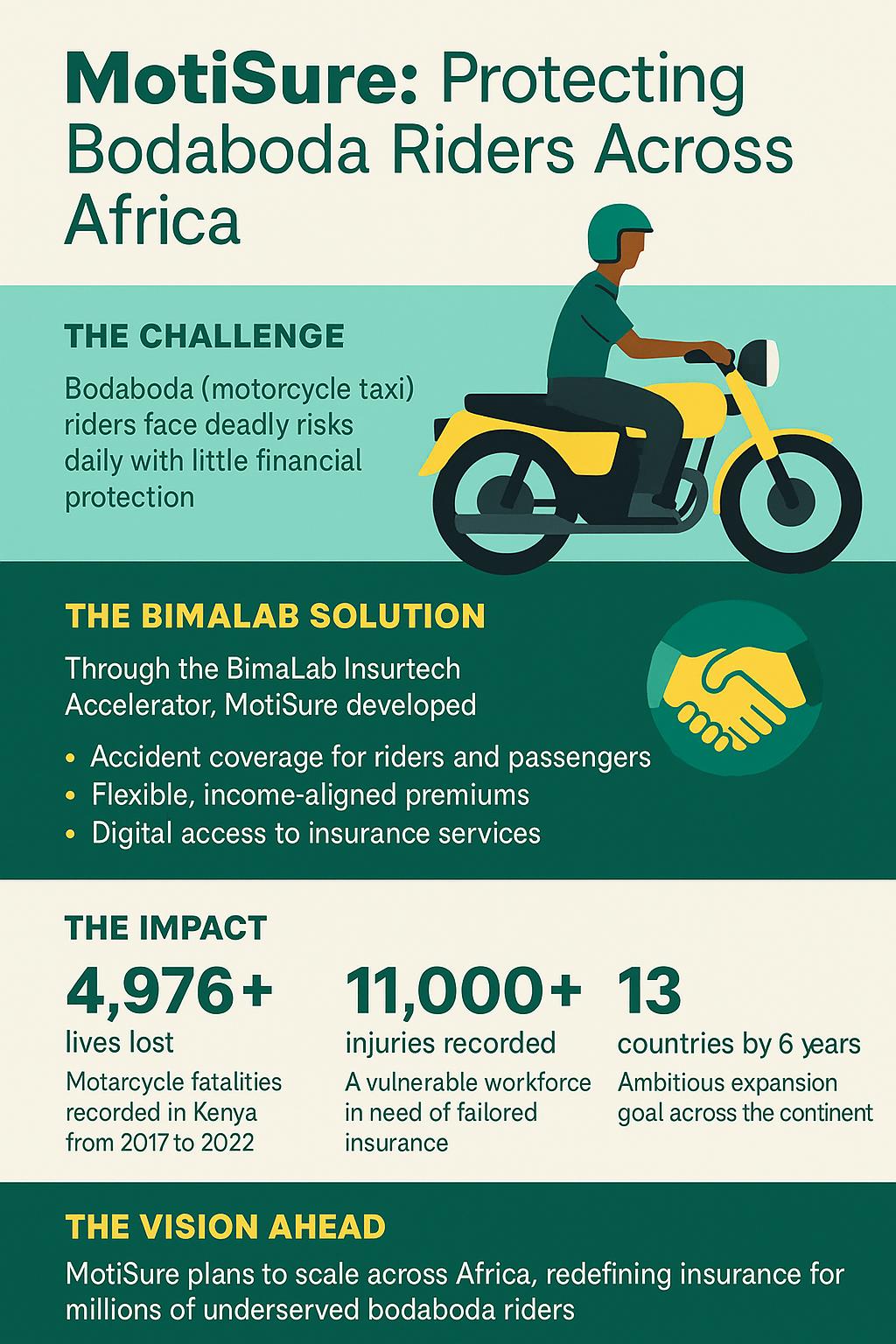

The statistics are sobering. Between 2017 and 2022, Kenya Police data recorded:

4,976 motorcyclist deaths

11,187 injuries

Each number tells a story of lives cut short, families left behind, and financial devastation for dependents. For Joel, this loss became a catalyst for action. He partnered with like-minded innovators to design insurance that speaks to the realities of riders—a safety net where none existed before.

A Vulnerable Workforce

The bodaboda industry is a lifeline for Kenya’s economy, employing millions of young people and supporting countless households. Yet, the very riders who power this sector are among the most exposed to accidents, theft, and financial shocks. Traditional insurance products rarely fit their needs—either too expensive, too rigid, or too inaccessible.

The gap was clear: an inclusive, affordable, and flexible insurance solution tailored specifically for riders.

4,976+

Lives Lost

BimaLab Accelerator

MotiSure’s journey took a transformative leap through the BimaLab Insurtech Accelerator Programme.

The programme provided:

• Mentorship from industry leaders and regulators

• Exposure to best practices in inclusive insurance

• Partnerships that unlocked scale and credibility

Through BimaLab, MotiSure connected with an underwriting partner operating in 21 countries—a collaboration that opened doors to regional expansion and distribution opportunities.

11,000+

Injuries Recorded

MotiSure’s Rider-Centric Insurance

MotiSure designed personalized microinsurance products tailored to riders’ unique risks:

• Accident coverage that protects both rider and passenger

• Flexible premiums aligned with riders’ daily income cycles

• Digital-first access, ensuring riders can sign up, claim, and renew with ease

The model shifts insurance from a privilege of the few to a protection for the many.

13

Countries by 6 years

The Impact So Far

• Thousands of riders now have financial protection where none existed before

• Families are shielded from catastrophic medical costs and income loss

• Insurance awareness among the bodaboda community is growing, building a culture of resilience

Beyond Kenya, MotiSure is positioning itself as a regional insurtech leader, reshaping how underserved communities view and access insurance.

Scaling Across Africa

Joel Macharia’s ambition for MotiSure is bold and transformative:

• 3-Year Target: Expand operations to 6 countries across Africa

• 6-Year Vision: Scale to 13 countries and evolve into a reinsurer for micro-insurers

This vision is not just about business growth—it’s about redefining insurance inclusion across a continent where over 80% of people remain uninsured.

BimaLab’s Ripple Effect

BimaLab has been instrumental in this journey—not only for MotiSure but for the broader ecosystem. By nurturing insurtechs, fostering partnerships, and enabling regulatory innovation, the programme has:

• Made Kenya a hub of insurance innovation in Africa

• Unlocked access to financial services for historically excluded groups

• Inspired a new wave of insurtech entrepreneurs who see protection as a right, not a privilege

For every rider protected, we prevent a family from falling into financial ruin. Insurance is not just a product—it’s dignity, resilience, and hope.”

Joel Macharia, Co-Founder, MotiSure

Summary