A Market in Need of Innovation

Kenya’s insurance market has long struggled with low penetration rates, leaving millions without adequate coverage. Traditional providers have been criticized for offering products that are too costly, too rigid, or too disconnected from the real needs of families.

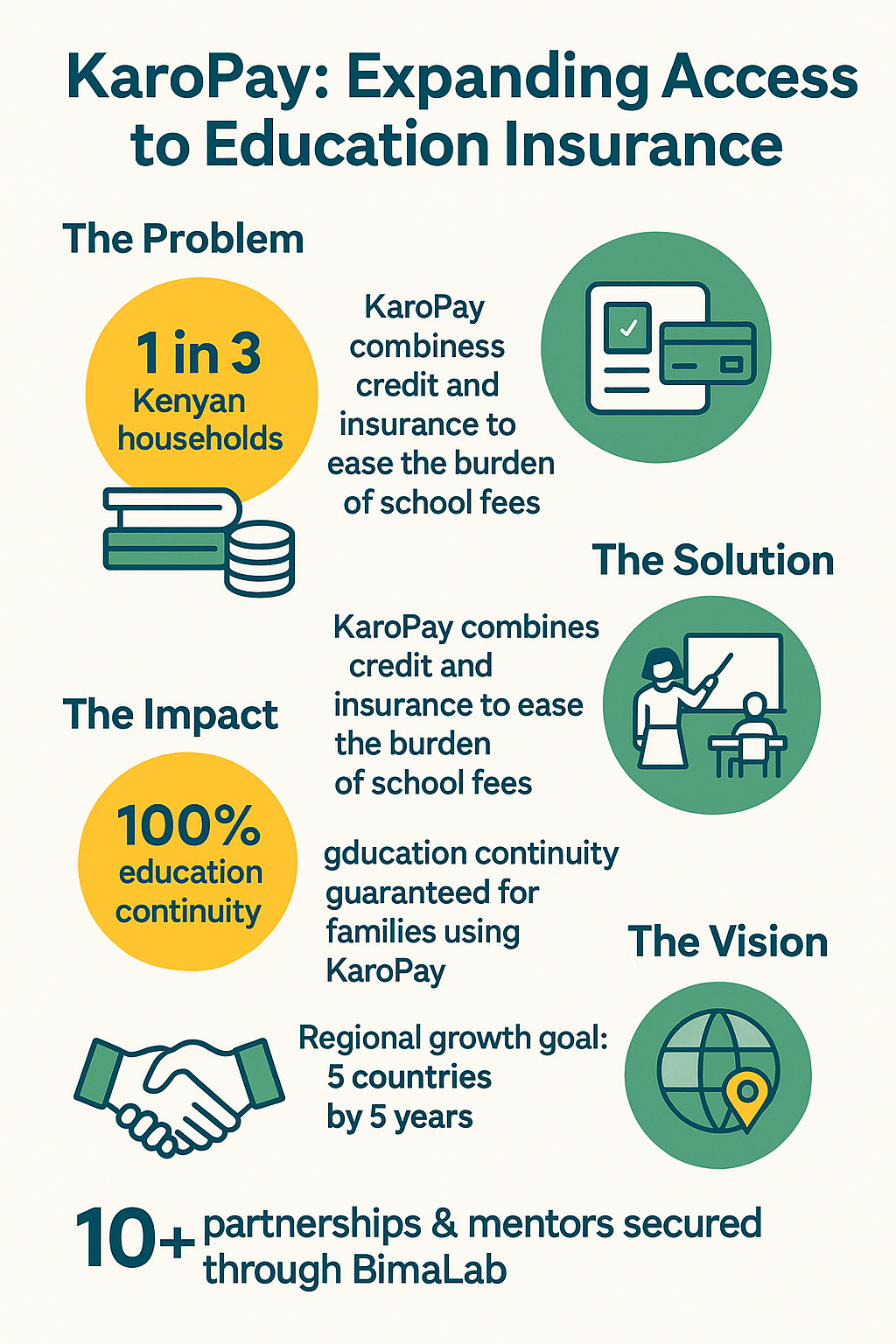

At the same time, parents across the country continue to face significant financial pressure in paying school fees, often forced to choose between debt, inconsistent payments, or sacrificing other essentials. The need for innovative, accessible, and practical financial products has never been greater.

Kenyan households – Struggle to pay school fees on time

Education Continuity

KaroPay’s Education-First Solution

For Brian Ndege, CEO and co-founder of KaroPay Credit, the problem was personal. His own struggles with university fees inspired him to rethink how families could be supported in managing education costs.

KaroPay was born as a hybrid product—combining:

• Credit solutions to ease parental cash flow challenges

• An education insurance policy to safeguard children’s schooling even in times of financial strain

This fusion created a unique value proposition in Kenya’s market: not just a loan, not just an insurance cover, but a safety net for education continuity.

Refining Ideas Into Scalable Impact

Through the BimaLab Insurtech Accelerator, KaroPay gained access to:

• Mentorship from global experts, including senior leadership from NuaPay, providing first-hand insights on building and scaling insurtech solutions

• Training and coaching on product development, market fit, and regulatory compliance

• Exposure to investors and partners, enabling credibility and pathways to growth

• Regulatory support through the Insurance Regulatory Authority (IRA), creating an enabling environment to pilot and refine products

For Brian and his team, BimaLab was more than an accelerator—it was a launchpad that transformed a promising idea into a structured, market-ready innovation.

Enabling Families, Strengthening Futures

• Parents now have access to flexible credit tied to an insurance policy, easing the burden of school fees

• Families enjoy peace of mind, knowing children’s education will not be disrupted by unexpected financial shocks

• Entrepreneurs like KaroPay have emerged as part of a new wave of solution-driven insurtechs, reshaping the insurance and financial landscape in Kenya

The Vision Ahead

KaroPay’s long-term ambition is to become a regional leader in education-focused insurance and credit solutions, expanding beyond Kenya into other African markets where school fee pressures are equally pressing.

BimaLab’s Ecosystem Effect

By nurturing KaroPay, BimaLab continues to play a vital role in:

• Deepening financial inclusion for underserved communities

• Positioning Kenya as a regional hub for insurtech innovation

• Shaping the future of insurance in Africa by combining technology, empathy, and local context

Partnerships & Mentors

5 countries by 5 years

BimaLab gave us the tools, mentorship, and confidence to refine our idea and build a solution that truly matters for families.

- Brian Ndege, CEO, KaroPay

Summary